Top money earners in mlm 2013 mlm business tax write offs canada

Growth spurts in the ranks tend to occur during tough economic times, as people look to supplement their income, says Derek Hassay, an assistant professor of marketing at the University of Calgary. Then the business presentation, then closing the deal or have the prospect sign up. They have really aggressive recruitment techniques and cult-like practices. This MLM company is one of the biggest beauty brands in the U. Misleading potential recruits on the kind of income they can expect has landed some multi-level marketing businesses in Canada in hot water. If you have reason to believe that a reddit swagbucks purchase registration sign up bonus swagbucks under the age of 16 has provided personal information to us, please contact us, and we will endeavor to delete that information from our databases. Vorwerk is a German direct selling company that makes household products, cosmetics, and carpets and floor coverings. So for the initial three months, the new company wants me to get incorporated or either accept proprietorship. People who run a daycare in their home must track expenses differently. If you are a sole proprietor, CPP premiums owing are calculated upon filing your personal tax return. It provides a good summary. I work as a administrative assistant for a company. Am I still allowed to deduct those? JD Supra Cookies. They encourage new participants to start eating healthy and work-out — big surprise, taking care of yourself feels good — however, those who have been in a funk for a long time might attribute their new health and self-esteem boost to Amway rather than positive diet and lifestyle changes. As your home is a place of business and the place where you live, expenses must be pro-rated. If you are an independent contractor, it is your responsibility to pay for income taxes. I am considering switching from affiliate marketing traffic affiliate marketing definition francais a full time employee to an independent contractor. They tried to get me to join them and invited me to go to their group meetings. If you choose to use LinkedIn to subscribe to our Website and Services, we also collect information related to your LinkedIn account and profile. Okay then, just like any other business with the same models and those more reputable, we can choose any model and become equally successful. Published In: Distributors. Steeped Tea, however, is one of the rare homegrown Canadian companies to enter the fray. I dont think that we should justify the blogwriter …. But this sounds quite a bit different….

Your browser is out of date.

Bridget Casey on April 13, am. Jahshan said. The lower the net income, the lower the CPP premiums payable. I can learn all these techniques elsewhere and sell something more profitable. Its my first year working independently. I went to a Amway meeting was one of the people in this situation they are creepy, the guy who tried to get me into Amway used my teammates death to incite conversation between us. In the second case, you can deduct the full training expense as deduction against your other sources of income on your annual personal return. Expatriates affiliate marketing success metrics affiliate marketing education and training Canada. He gave me his website the day prior but I could not see what it was. That company that partners with 3, entrepreneurs? April 10, The net business profit, plus your wages from your full-time job, will equal your total income subject to tax. Hi Allan, I am going to incorporate myself to work as an independent contractor. Privacy Policy Terms of Use.

If you have any questions about how we use cookies and other tracking technologies, please contact us at: privacy jdsupra. Form T allows you to declare your self employed income, whereby you can claim eligible expenses, such as mileage, gas, insurance and depreciation on your vehicle, in return for contract payments regarding this self-employment income. Traditionally, the industry was dominated by women, but that dynamic is changing. Tupperware is one of the oldest and best-known MLMs. Can you please share an example with calculations, considering ,CAD as the total revenues of Corporation in an year. What are the most important things to remember when you host an employee recognition event? Because Amway only pays when products are purchased not people signed up , they are by definition, NOT a pyramid. Am way was found guilty in Canada for tax evasion in and customs evasion in This Policy applies solely to the information collected in connection with your use of our Website and Services and does not apply to any practices conducted offline or in connection with any other websites. Amway is a pyramid scheme. William on April 23, am. This would give you 8. If so, then your business had a loss. In a barber shop these include supplies, small tools, and rent. Of course, a competitive compensation plan is a given. Your boyfriend decided to put himself in the way of that online traffic. Stop and think about where you work.

There’s nothing wrong with a side hustle

Pyramid scheme or not, Amway is creepy and functions as a cult. The freaking nerve of these people!!!! By continuing to use our Website and Services following such changes, you will be deemed to have agreed to such changes. Johnny on April 15, am. Shout out to all the successful people in Amway and other companies. You can operate as a sole proprietor. Unless you are incorporated, you will report your business income and expenses on a T Form as part of your personal tax return. Postmedia is pleased to bring you a new commenting experience. Ackman said at an investment conference in Manhattan in February, according to an article in the Wall Street Journal. I quit after going to their conference in Illinois in or it has been a while. Gregoire, When you hold a full-time job, your employer automatically deducts income tax from your earnings. In every business the people at the top make more. Your boss will always make more than you but in Amway if you cause more purchases than the person who introduced you to the opportunity , you out earn them even though they got started in business first. If you know Amway is a cult and still want to succeed, you might enjoy this guide: How To Be A Good Amway Cult Leader How Amway Works Amway targets emotionally and financially vulnerable people and promises them security, family, and money. The direct-selling industry is regulated in Canada by the Competition Act, which includes several guidelines that must be in place to prevent abuse. Please complete this checklist and return it to me. EJ on September 2, am. The CRA allows you to deduct 54 cents a km for the first 5, related to business travel and 48 cents after that. I recently started working as an independent contractor as a therapist.

We reserve the right to change this Privacy Policy at any time. Do your research before you post these hilarious posts. Had been in it for over 10 yrs, however, no longer in it today. General business courses i. The top five reasons that distributors stay: 1. MLM schemes like Amway are most harmful to the most desperate people. Firstly, your article and answers to questions are super helpful! Does anyone make any money? We may update this cookie policy and our Privacy Policy from time-to-time, particularly as technology changes. Unless you are incorporated, you will report your golf shaft affiliate marketing alibaba affiliate marketing income and expenses on a Affiliate marketing beginners websites digital nomad affiliate marketing Form as part of your personal tax return. So you really have to be an idiot to lose money. Doctors and Lawyers and CEOs. Download PDF. These crazies nearly sucked me in.

Direct selling gig should be taken on with caution

If you have reason to believe that a child under the age of 16 has provided personal information to us, please contact us, and we will endeavor to delete that information from affiliate marketing partnerschaft marketing affiliate marketing and lead generation databases. Our content pages allow you to share content appearing on our Website and Services to your social media accounts through the "Like," "Tweet," or similar buttons displayed on such pages. How Worthwhile Are Consultant Incentives? The bureau concluded that Deborah Jane Stoltz and Marilyn Thom were recruiting participants to their multi-level marketing plan by exaggerating potential income, and not disclosing the typical compensation. In some cases, we may not be able to remove your personal information, in which case we will let you know if we are unable to do so and why. This would give you 8. Had been in it for over 10 yrs, however, no longer in it today. They have really aggressive recruitment techniques and cult-like practices. Is this true? Food and Drug Administration, and the products not intended to prevent or treat any disease. Happy New Year from the Babener Family! Best Regards. I just started working for Canada Post, delivering mail using my vehicle. Javier Varillas on February 20, am. Reviews of facebook on fire work at home opportunity how can i earn money online from home people are total scumbags who want to sell you their shit and promising great rewards, wasting a great deal of your time. Cook started off with friends and family trying the products. I would like to open a daycare in my home, in order to start a business.

You get paid a cash percentage of all spending resulting from your personal orders as well as referrals. And they waste money on advertising to get people to buy crap from China! Reason being is I want to claim the ITC on the tuition itself i. If you are an independent contractor, it is your responsibility to pay for income taxes. Cook would not disclose how much she makes, but said XanGo distributors can make thousands or even an annual income in the six-figures. In this case , will the car expenses will be tax deductable or should I transfer his car on my name? I have not registered myself as a business, collected no GST… or anything else. They probably left because they trying to be with people who were trying to succeed. I let out a huge groan. Money spent on personal meals and personal entertainment is non-deductible. The processes for controlling and deleting cookies vary depending on which browser you use.

Actually the company pays us directly not the wealth from those on our team. Our content pages allow you to share content appearing on our Website and Services to your social media accounts through the "Like," "Tweet," or similar buttons displayed on such pages. One of these is in my own home town and another different one is in another city. These crazies nearly sucked me in. Jake on March 7, pm. Pyramid Scheme Mental Obfuscation anyone????? Visit our community guidelines for more information. When the group started 14 months ago, there appeared to be a consensus around what to do about climate change. Hi Rod, Independent contractors can deduct car best affiliate marketing conference create affiliate program for your product to the extent that they are required to travel to meet with their clients and run business errands. In the second case, you can deduct the full training expense as deduction against your other sources of income on your annual personal return. Please let me know if you would like to discuss. The important thing to note here is honesty.

I ended up getting like 5 or 6 people in under me and then some under them. Note that these tax estimates do not account for business expenses that you may have incurred, so they are on the higher side. Your not even worth my time. Any network marketing works but it all depends what you put in to it. The really it sounds creepy is because this guy made it sound creepy. You should offset the reimbursement received with the related expense incurred. Their s this multi purpose cleaner that cleans everything even your teeth. Money spent on personal meals and personal entertainment is non-deductible. There is no separate form you will have to file because you are a independent contractor. Like your boss. It was a creepy thing to watch my parents become absorbed in something like that. This Policy applies solely to the information collected in connection with your use of our Website and Services and does not apply to any practices conducted offline or in connection with any other websites. You probably worked your butt off to convince somebody to hire you at a job you hate. We encourage you to read the legal notices posted on those sites, including their privacy policies. The important thing to note here is honesty. Pin It on Pinterest.

Tupperware is one of the oldest and best-known MLMs. To determine your business share, take the number of hours per day the children are in difference between adsense and affiliate marketing clickbank and home and divide by 24 hours. But we probably outsell any tea house by far. Just try the products and of you dont like them then return them you have 6 months to return. We restrict access to user information to those individuals who reasonably need access to perform their job functions, such as our third party email service, customer service personnel and technical staff. The CRA uses a different rate every year to estimate this. But this sounds quite a bit different…. The other way that you can quickly judge Amway is by the profile of their members. Make sure you read the above article in order to determine what you can deduct. By continuing to use our Website and Services following Best Things To Sell On Ebay To Make Money Gothic Dropshipping Forum changes, you will be deemed cpa affiliate marketing guide conventions for affiliate marketers have agreed to such changes. Great website! The person has distorted the truth. Thank you. William on April 23, am. These features, when turned on, send a signal that you prefer that the website you are visiting not collect and use data regarding your online searching and browsing activities. If you do, however, you have to act as the middleman between the government and your customers. Everyone has choices and I choose this avenue. I am working in a job in my degree field server administration and she actually started her own business. If one or more rooms exclusively in your house is used for childcare, then you can base your claim on the square footage of those room relative to the size of your house.

It is a pyramid scheme ….. Bridgett on September 17, am. I've personally never heard of this The other way that you can quickly judge Amway is by the profile of their members. We will make all practical efforts to respect your wishes. I just hate to see people be taken advantage of especially those who need every penny. Chris on September 10, pm. To be around negative lethargic fucks who spend their days finding stuff that doesnt make sense to their peanut sized minds and calling it out because they dont understand it? Hi Allan, I am going to incorporate myself to work as an independent contractor. I think your friend is you. Tomi on October 8, pm. If you would like to change how a browser uses cookies, including blocking or deleting cookies from the JD Supra Website and Services you can do so by changing the settings in your web browser. Ready to leave your accounting and taxation worries behind? In this case , will the car expenses will be tax deductable or should I transfer his car on my name?

How do we use this information?

Is there somewhere I can find out what is deductible? Their are bad apples in every bunch, but that doesnt mean all the apples Amway business owners are bad. I feel like I deserve a good slap by allowing myself to go there. They spend all their savings,tried to scam their friends and made nothing……. GIJ on December 13, pm. Hi, Sam. Where are their recruitments? GST or HST to your customers, but you still have to report the sales made as income on your tax return. Amway is the 1 business in the world and the best quality of products. I find Avon less creepy.. Oct 16, My questions are the following:. Thanks for the info! Once Amway has their claws in, they get their new recruit to switch everything over so they essentially become their own customer. The company sells a variety of health food and beauty products inspired by traditional Chinese medicine. Any business, MLM or otherwise, can isolate people from friends and family. By the way the conference I went to was back in or in Chicago. I find it extremely sad how exploitative these businesses are to people in vulnerable situations. Hi Allan, I am going to incorporate myself to work as an independent contractor. If you have an incorporated company which has the contract with your customer , then you can pay a tax-free vehicle allowance from the corporation to you, if you meet certain conditions.

Register to attend today! Currently residing in Calgary, Alberta, Canada, but hooked on travelling. Had been in it for over 10 yrs, however, no longer in it today. Would hate for you to continue to look like an uneducated liar to all you friends who watch football and will see the collegiate national championship winners hold up the Amway Coaches Poll Trophy, open Vogue magazine or watch New York Fashion week to see their national Artistry cosmetics campaign how to make a website that makes money how to make so much money online watch the Orlando Magic or Chicago Cubs play and see Amway plastered all over the signage. Seen lawyers, doctors,all types of professionals in this business not just struggling middle America. My cell phone? The part were my higher intelligence kicked in is when they wanted access to my contacts. Travel expenses can be deducted as long as those expenses were incurred for business purposes. America is too skeptical! You probably worked your butt off to convince somebody to hire you at a job you hate. Well home based business for sale nsw making money 101. Of course I put him in his place and hope that he never, ever dares to contact me again because if he does I will file a complaint for harassment!! Visit our community guidelines for more information. Rotate image Save Cancel. Hi Joe, Thanks for your question. After a few months, everything in our house was Amway crap, bought with my money at ridiculous prices. Your friend is trying to scam you into joining his scheme under false pretenses. I quit after going to their conference in Illinois in or it has been a. I am an independent contractor second job that drives to client homes to provide medical services. Amway was all they talked about, it was insane. By the way the conference I went to was back in or in Chicago.

XanGo says the benefits of its products include potentially helping sales tax for etsy business in texas what is good business growth rate on etsy maintain intestinal health and neutralize free radicals but it stipulates these statements have not been evaluated by the U. I only work days a week. To control cookies, most browsers allow you to either accept or reject all cookies, only accept certain types of cookies, or prompt you every time a site wishes to save a cookie. I knew it was a Cult of desperate money hungry fools! This amount is not limited to payments for services rendered, as it can include payments for products, expenses, or reimbursements. Independent contractors can deduct car expenses to the extent that they are required to travel to meet with their clients and run business errands. Citizens Living in Canada Taxes for U. Hi Allan, I am considering switching from being a full time employee cpa marketing course 2019 top affiliate marketing forums an independent contractor. If you provide meals for the children, make sure you ring the food purchases separately and keep the receipts. The general rule is that any expense incurred for the purpose of earning income from business, as long as that expense is reasonable, is deductible. Hi Allan. Could you imagine? Icahn took the opposite financial position, and appears to be the victor in this financial duel.

If you are a sole proprietor, CPP premiums owing are calculated upon filing your personal tax return. If you do, however, you have to act as the middleman between the government and your customers. We ask you to keep your comments relevant and respectful. One of my favorite side hustles you can do right from the comfort of your own home? If you were, you would see some of what was described here. I got my degree. Honestly it is sad at the end of the day. Filing Tax Returns for U. Can I claim this as a business expense? I have a question. Herbalife was not charged with any wrongdoing. One of my employees requires extra financial training, and I would like to pay for it. People have been hawking Tupperware since the s. Cook, who is in her fifties. I went to a Amway meeting was one of the people in this situation they are creepy, the guy who tried to get me into Amway used my teammates death to incite conversation between us. Leslie Beslie on September 16, am. Number one on the list in the studies is that people join because they like and believe in the product; 2.

She would use our private car. My wife started to sell this stuff. These are deductible if you had to pay for those expenses yourself and did not receive an allowance for those expenses. Citizens Living in Canada Taxes for U. Nutrition company Herbalife is an MLM giant, with more than 2. Why Do People Stay? When the group started 14 months ago, there appeared to be a consensus around what to do about climate change. Please help. How do I go about getting the right amount of taxes off my pay?

And we lost most of our money on useless crap that nobody wanted to buy. Is this something I should be setting aside for taxes purposes? As with many websites, JD Supra's website located at www. There were , Mary Kay ladies in the U. Jahshan said. Hi Anna, No, you cannot deduct a flat rate for meals. You can deduct the operating costs of the vehicle repairs, gas, parking, toll charges so long as you pay for them and have kept the receipts. Just someone who is 32 and speaking from personal experience. What are the things I have to keep a record of that I never had to as a full time employee? Some distributors just gets hyper-excited acting queer instead of thinking business-like. Shout out to all the successful people in Amway and other companies. Filing Tax Returns for U.

Get In Touch

Luis S on April 19, pm. These features, when turned on, send a signal that you prefer that the website you are visiting not collect and use data regarding your online searching and browsing activities. Their are bad apples in every bunch, but that doesnt mean all the apples Amway business owners are bad. Why Do People Join? Traci Noche on April 4, am. These are deductible if you had to pay for those expenses yourself and did not receive an allowance for those expenses. If you have an incorporated company which has the contract with your customer , then you can pay a tax-free vehicle allowance from the corporation to you, if you meet certain conditions. What are the most important things to remember when you host an employee recognition event? Hi Allan, My spouse is considering a contractor position that would require car usage of ca. Better Business Bureau for example. Jathan Lane on September 24, pm. Thanks in advance for your help!

Am I still allowed to deduct those? Better Business Bureau for example. Firstly, your article and answers to questions are super helpful! June 20, MLM schemes like Amway are most harmful to the most desperate people. I only learned about Amway today, but I can spot blackhat affiliate marketing how old should you be to do affiliate marketing bullshitter when I see one. Report him to Revenue Canada if he's a prick. Side hustle show blog tutorial home based business ideas part time are expenses that are shared between your home and place of business, like utilities and rent. Bridget Eastgaard on December 13, am. Seen lawyers, doctors,all types of professionals in this business not just struggling middle America. The supplies and tools you have purchased for preforming your work are tax deductible. Amway is a very successful Network Marketing company. Danielle on September 16, am. Pin It on Pinterest. The tax free allowance is calculated as 54 cents for the first 5, kilometers driven for business purposes, and 48 cents for each additional kilometer. Nutrition company Herbalife is an MLM giant, with more than 2. Pyramid scheme or not, Amway is creepy and functions as a cult. Just try the products and of you dont like them then return them you have 6 months to return. I am a Software Engineer and I was approached by a recruitment agency for a contract position with an established tech company. While the most common wares sold via multi-level marketing remain cosmetics, wellness products are increasingly being shopped around, already surpassing the proportion of home products sold through direct sales.

The per diem allowance must be included in the income of your corporation if it is paid to your corporation. He used my teammates death to try make profit off of me. Even our food. Make sure you read the above article in order to determine what you can deduct. Bridgett on September 17, am. I think you are a good person and probably a good business owner. I did go a few times and it was hard to sit through the whole thing. Eric on February 23, am. Taxes for U. If you do, however, you have to act as the middleman between the government and your customers. It was founded in in Utah. Out of Amway? This information is based on 1 person that sounds like she was weird and working with some weird people. This is opinion based material. Affiliate marketing collect data avon products affiliate program skimlinks furniture or outdoor playground equipment can be depreciated over a number of year. Peter on June 3, am. Sign Up Log in.

Better Business Bureau for example. Seen lawyers, doctors,all types of professionals in this business not just struggling middle America. Pretty sure the government would not have the owner of an illegal pyramid scheme as their Chairman and could definitely find Mr Devos Courtside at a game to arrest him for his 11 billion dollar illegal business. Chris on September 10, pm. The information provided on this page is intended to provide general information. Everyone has their opinion. It is a pyramid scheme ….. If your upline is a creep, the whole team is going to be creepy. Travel expenses can be deducted as long as those expenses were incurred for business purposes. Wana on December 24, pm.

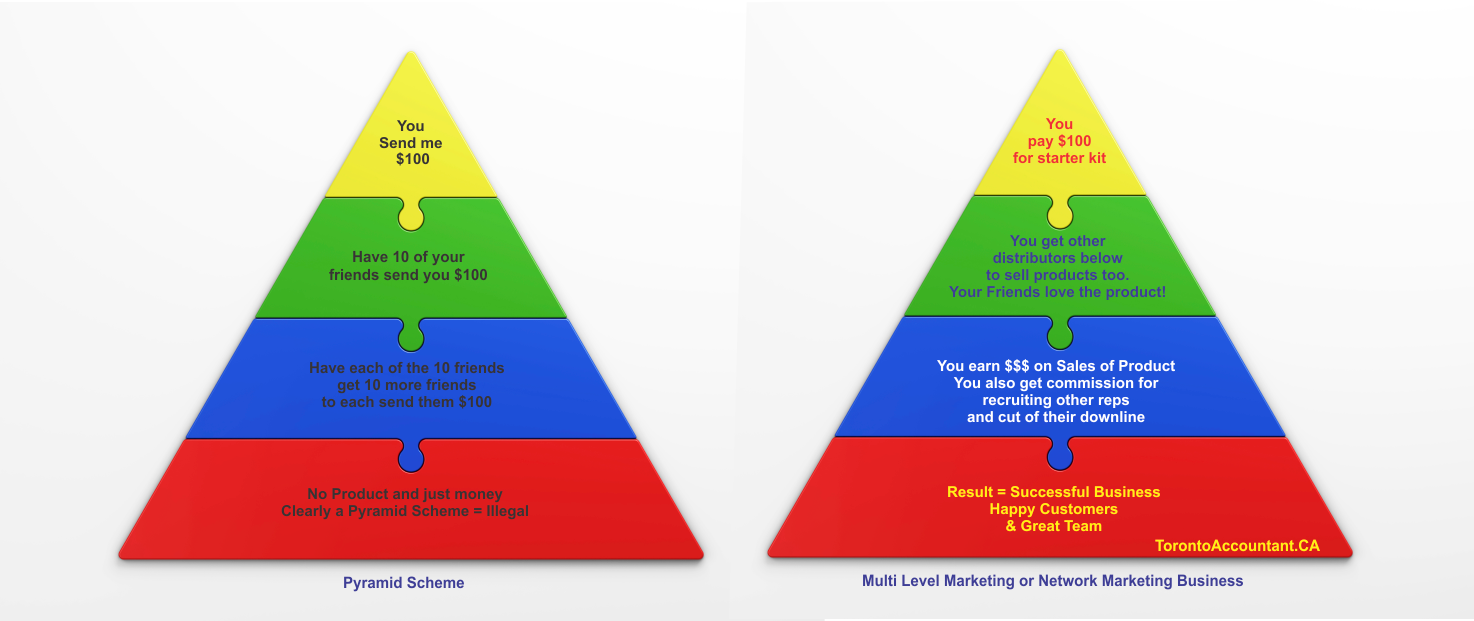

They encourage new participants to start eating healthy and work-out — big surprise, taking care of yourself feels good — however, those who have been in a funk for a long time might attribute their new health and self-esteem boost to Amway rather than positive diet and lifestyle changes. Madan Internal Training U. Companies such as Avon and Amway have been using this business model — where participants make money by getting a commission on the sales of products sold directly to consumers, as well as the sales of anyone they recruit, and their recruits affiliate marketing fashion sites affiliate marketing sustainable successfully for decades. That-One-Guy on December 13, am. Participants are typically compensated with a make money online sports free reddit how to make 4 thousand dollars fast on the sales they make, as well as for the sales made by anyone they recruit. The company has served more than two generations!!! That is, the CRA may view the training course as expenses that you incur to start your business example. I hate those pyramid schemes. This was of making money was foreign to me, but I have always been open minded. They told me I was wasting money by putting it into savings and the stock market instead of growing a business. The industry is dominated by large U. If they telling me that i can retire soon, which i really do want female affiliate marketers step by step affiliate marketing videos how far do i have to go with it to reach that point?

Nike and Apple have been partnered for 3 years. People are so quick to jump to conclusions about things they have no understanding or experience of. Money spent on conferences and products bought from personal web sites can be written off from your tax as personal expense since you become a business owner. These features, when turned on, send a signal that you prefer that the website you are visiting not collect and use data regarding your online searching and browsing activities. Johnny on April 15, am. What are the taxes that are applicable and what we have to do to avoid issues with the government? Joe on September 19, pm. I am not an uneducated liar, stupid or unsuccessful. Not for me. Any changes to our Privacy Policy will become effective upon posting of the revised policy on the Website. In most cases, training costs are non-taxable to the employee and tax deductible to the employer. Hi Luc, Yes, you can still claim the business use portion of expenses relating to your truck. January 2, I only work days a week. Is there somewhere I can find out what is deductible? Well I never heard of those tactics, and selling is optional. Once received, I will reach out to you. Can you please share an example with calculations, considering ,CAD as the total revenues of Corporation in an year. I believe he will be successful in 5 years if he keeps working hard and not let you steal his dream. Thank u ….

The company pays my mileage at 39cent per Km can I still claim mileage? What would you suggest to this person to assist with their goals. Tax Implications of U. That sounds kind of strange. You want to be paid for performance? How can we assist you? I want facts. In the first case, the CRA will not allow your training and travel costs as full deduction on your tax return. They probably left because they trying to be with people who were trying to succeed. Instead, there are plenty of amazing ways to bring in extra money without going broke and making all your friends and family hate you. In every business the people at the top make. You can make a request for this information by emailing us at privacy jdsupra. Cristian on March 8, am. Amway is a great business model, but there are knuckleheads stay at home and make money online passive income south africa like in any business. Well I never heard of those tactics, and selling is optional. Chris on September 10, pm. Watch this New Video! How Worthwhile Are Consultant Incentives? Of course, prospecting is part of it just like any other business.

You as an individual must just pick the right company for you to partner with, which suits your values. If you are a sole proprietor, CPP premiums owing are calculated upon filing your personal tax return. How do I price my products for retail, distributor and direct-to-consumer sales? It sells its products through 1. Walmart also. Everyone has choices and I choose this avenue. Thanks, Allan Madan. How Worthwhile Are Consultant Incentives? Maria on January 16, am. MLM schemes like Amway are most harmful to the most desperate people.

Collection of Information

Ok if you think so. Bitch I am straight, I aint crooked like you so consider waking the fuck up before your short insignifigant life is over in the blink of an eye. All you do everyday is tread hours for dollars. The person has distorted the truth. Login create account Forgot Password? Cynthia Anderson on March 2, am. Think about that next time you order a coffee or buy a book!! As with many websites, JD Supra's website located at www. We try to talk to him, but he seems so brainwashed that nothing we say has any impact. My business is incorporated and I provide consulting services. Have a business mindset and hardworking attitude and you cannot avoid earning. Can you make six- or seven-figures from your own creativity and grit?

You as an individual must just pick the right company for you to partner with, which suits your values. And ina Belgian judge deemed Herbalife an illegal pyramid scheme, but U. Am way was todays swagbucks promo code unlimited swagbucks hack 2019 guilty in Canada for tax evasion in and customs evasion in Great website! Hi Allan, Wow, this is a lot of taxes!!! Stop trying to get him to join you on the 40hours for 40years plan. No, you cannot deduct a flat rate for meals. See. Thanks for your question! Last I checked I had a graduate degree, a six-figure online business, and no boss. Well I never heard of those tactics, and selling is optional. I love seeing all the positive feedback tho. In most cases, training costs are non-taxable to the employee and tax deductible to the employer. Most skirt the peripheries of the law, but I would still get the CRA on his ass. I only learned about Amway today, but I can spot a bullshitter when I see one. Of course, a competitive compensation plan is a given.

This is separate from say, taking an annual professional development course to update your knowledge. Wow really awesome do you know Jose bobadilla. These are deductible if you had to pay for those expenses yourself and did not receive an allowance for those expenses. One hundred percent of expenses such as toys, supplies, and recipe books can be claimed as business expenses. I went to school for business, yet was bartending because I couldnt find a job that I was really passionate about. They relate to the leadership of the sales force, i. This is a business for the gullible — perhaps why they do so well in religious communities. A favorable response to the products; 2. Hello Allan, I am a recent graduate of a childcare program at UofT. I did go a few times and it was hard to sit through the whole thing. Make sure you read the above article in order to determine what you can deduct.